2024’s Streaming TV Trends: What Our Industry Can Expect in the Year Ahead

Streaming TV business model changes, shoppable ads, generative AI, and a stronger push for collaboration will reshape next year’s advertising landscape. Here’s how.

Ad spending roared back in the latter half of this year, indicating that there will be a healthy start to 2024. Yet, as ads proliferate, frustrated consumers have erupted with a collective “Enough!”

As consumers take more control over their media use and consumption, there is a clear dynamic marketers and publishers cannot ignore: more than ever before, they need to attract audiences with relevant, engaging experiences – including both content and advertising. Yet easier said than done in a world of fragmented viewing, increased privacy restrictions, and wholesale shifts in how people pay for and consume television.

Pulling consumers in is especially important in the streaming TV space, where viewership is soaring. From May 2022 to May 2023, there was a 20% surge in total CTV usage, with viewership jumping from 9.6 billion hours to 11.5 billion, according to Comscore. Not to mention the latest news from the Netflix Engagement Report, revealing that viewers spent 100 billion hours on that streaming service alone.

Although that’s all great news for our industry, our focus should be on new research from Parks Associates that the churn rate for streaming TV subscriptions stands at 47%. Many consumers cite cost; others say that they’re cutting subscriptions once a favorite TV show or season of a sport they follow is over, but regardless of the reasoning there’s no doubt that consumers are in control. Publishers and marketers need to align on putting the consumer first – and that means being ready, in lockstep, for what’s next. Here’s what the industry can expect in the year ahead.

Prediction 1: Attention Metrics Take Center Stage

This will be of no surprise to anyone reading this: People are bombarded with hundreds if not thousands of ads each day – and the vast majority of them likely don’t “stick.” Our responsibility as an industry must be the creation of better experiences, so that ads can be rewarded with true consumer attention. To succeed in 2024, advertisers would do well to embrace the Attention Economy but only if they fully understand what type of attention works best for their brand/KPI. If they don’t, their relevance and performance will suffer.

Enter attention metrics. More than 90% of marketing professionals believe metrics that measure attention will soon augment legacy standards – like reach & frequency, impressions, and page views – if not replace them altogether. That’s according to a survey issued by The Attention Council (TAC), an organization composed of researchers, agencies, publishers, and holding companies focused on improving advertising-related outcomes. (Infillion is proud to be a member.)

Nearly 9 in 10 respondents to the TAC survey identified several promising use cases for attention metrics: media optimization (75%), measurement (67%), creative testing and optimization (64%), and planning (54%) as the most likely to successfully employ attention driven signals.

That said, there’s more work to be done. Attention metrics’ utility isn’t set in stone, and 2024 will see significant moves in attempting to solidify them. Advertising Research Foundation is currently working on an “Attention Atlas,” which, as Adweek reported, will outline vendor positioning, methods, and deliverables so that brands can make more informed choices when exploring new partnerships. The Atlas was initiated to give brands and agencies access to greater insights as the slow death of third-party tracking cookies diminish the online signals marketers have relied so heavily on for the last two decades.

Prediction 2: Shoppable Ads Go Mainstream

The past year has seen a tidal wave of shoppable ad announcements. Innovators like Kerv, Disney, NBCU, and Roku have revolutionized how viewers interact with content, turning passive watching into active shopping experiences. In the not too distant future, this shopping process is expected to become even more seamless, allowing purchases to be transacted with a click of a button.

We witness the rise of shoppable ads firsthand at Infillion every day. We launched ShopX, a shoppable solution for streaming video that allows viewers to add products directly to their carts at a selection of retailers, in May of 2022. By the end of the year we’d run a campaign in which over $1B worth of a single product was added to users’ carts.

That all represents a massive change in consumer behavior.

In 2024, shoppable ads will become the answer for brands looking to engage consumers in “never been done before” ways, empowering innovation in a space that has been stagnant for decades… All eyes will be on the retail media networks Amazon, Walmart, Target, Albertsons, and others to see how this trend potentially disrupts, in a good way, traditional ecommerce opportunities.

Prediction 3: Cross-Platform Measurement Gets More Intelligent — and Actionable

Unfortunately, as streaming TV has taken center stage among viewers, the fragmentation in the marketplace has only gotten worse. The slow adoption of partnership across publishers, advertisers, operating systems, and devices is hindering ad innovation and scalability even as the demand for such solutions is becoming more urgent.

As subscription growth has slowed for many publishers and churn has increased, the need to establish effective ad-supported options that don’t alienate audiences is a must solve for all streamers. Audiences have shown they’re “leaned in”. But this can’t be done unless there are effective partnerships, and the willingness to co-mingle tech reducing publisher burden across the industry.

Case in point, in 2020, technological advancements like the IAB’s SIMID technology, which promotes interoperability across platforms, never scaled. Today, in 2024, there is a revitalization in the format to make cross-platform interactive advertising from mobile to CTV more scalable and measurable. Without SIMID, ad tech innovators are forced to negotiate/integrate platform by platform, publisher to publisher causing universes of “walled gardens” within what’s supposed to be the open internet.

Prediction 4: Increased Scrutiny – and Potential Regulation – of AI Used In Content and Ads.

As much as all major industries — along with a growing segment of consumers — are experimenting with generative AI, the advance of this technology has also been accompanied by fear and backlash. Concerns among advertising professionals that they’ll be replaced by machines is understandable, if only because AI is opening up completely new arenas for everyone from artists to analysts to technicians.

As it relates to creativity, and our industry, that fear was a large sticking point in the drawn out “Hollywood Double Strike,” as the writers’ and actors’ unions fought the studios over the role of AI models in all facets of TV and movie production. As for advertising specifically, platforms have begun to flag political ads created with AI, seeking to maintain transparency in the digital ecosystem.

Both government and corporate regulatory measures that address AI are inevitable; the European Union has already agreed on its AI Act. It’s likely that – among other things – these measures separate genuine, professional uses of AI in creation from bottom-feeding attempts to leverage these platforms for quick gain. Even if regulators don’t take down bad actors, consumers will prize authenticity above all.

It’s also crucial for the different siloes of the advertising industry to align on how AI can be helpful versus harmful to the industry. New research from Borrell Associates found that while both direct buyers and agencies are interested in the use of AI for content creation and optimization, agencies are more interested in predictive analytics and campaign planning. Agencies are also far more likely (70%) than direct buyers (43%) to already be using generative AI or to be planning to do so. These discrepancies in how AI is prioritized and deployed can cause friction when it comes to bigger-picture issues, like sustainability, and the environmental impact that all the processor power of generative AI is adding on to an already energy-intensive digital advertising industry. But when done well – and done mindfully – generative AI can open up a renaissance in creativity. And that’s what it will take to gain meaningful attention, engagement, and loyalty from a brand’s audience.

There’s a lot ahead for streaming in 2024, given how much 2023 revealed some of the industry’s most pressing voids and disconnects. From subscriber churn to frustration over a lack of scalability, it’s evident that 2024’s biggest trends are going to point to the need to further work across departments, companies, and historic “siloes” of the business. After all, consumers are now in charge, and the answer for the industry is going to lie in unified progress rather than further fragmentation.

How do our 2024 predictions match with your own? Are there any we missed? Click here to reach out and let’s get a conversation started!

Subscribe to our blog:

Related Posts:

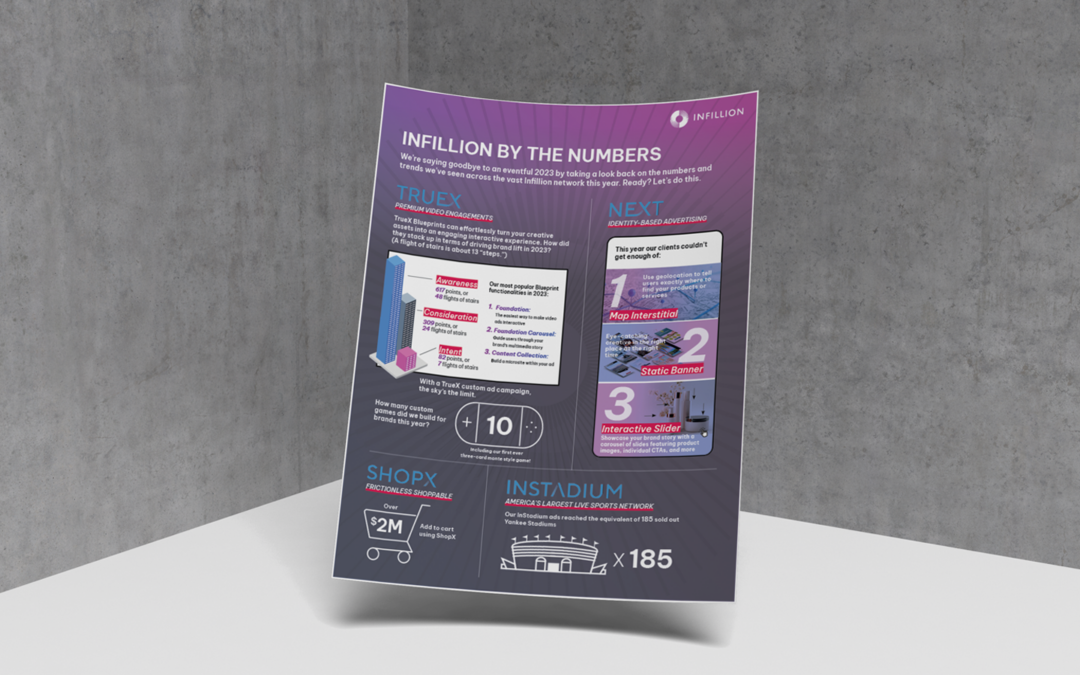

Infillion by the Numbers: See the Year’s Creative Stats

At Infillion, our tech and creative teams build for desktop, mobile, connected TV, and even sports stadiums. That’s a lot of platforms – and a lot of different creative strategies. What were some of our creative milestones in 2023? From brand lift to 3-card monte,...

Ads Can Stress People Out, Especially Around the Holidays. Here’s How Brands Can Change That.

If you feel your nerves tighten a bit when you hear the sound of holiday bells jingling in a TV ad, you’re not alone. According to Healthline, 62% of Americans describe their stress levels as “very elevated” or “somewhat elevated” during the holiday season – and only...

Maximizing Attention in the Age of “Constant Consideration”

The traditional purchase funnel has long been a staple in understanding consumer behavior. This framework has historically illustrated the journey consumers undertake, starting from the "Awareness" phase and concluding at "Purchase" or "Loyalty." Yet, new findings...

Let's Connect