Five Tech Trends for Marketers at CES 2023

As the behemoth that is the Consumer Electronics Show rolls into Las Vegas, taking over virtually every convention center and ballroom in its path, it’s easy to get overwhelmed by the sights, sounds, and churning sea of humans and gadgets alike. In other words, there’s a lot of noise, and it can be tough to separate out the signal. Plus, when marketers go to CES, it’s easy to get caught up in client meetings and miss the “consumer electronics” part of the Consumer Electronics Show.

At Infillion, we’re all about putting the consumer first, which also means that consumer trends at CES are just as important as what’s impacting us in the ad industry. To help us distill what to expect at CES 2023, we enlisted journalist and CES veteran Brent Rose, whose work you may have seen in the likes of Gizmodo, Wired, The Verge, The Wirecutter, and more. Brent has covered CES for more than ten years and has an eye to what consumers are looking for so we’ve asked him to provide insight on a handful of things to look out for at CES.

It’s the first real CES since COVID-19. What’s going to be different?

At last, CES is back. Well, technically it was back last year, but the raging Omicron variant of COVID-19 caused most major companies, ad agencies, and journalists to pull out, often at the last minute. This was especially true for foreign brands that had to travel long distances and deal with entry requirements at both ends of varying stricture. In short, last year’s CES was a bit of a ghost town, with most announcements coming via press release or video stream. This year you can expect brands to try to make up for lost time by leaning in heavily to the physical experience. CES has always been centered on going hands, eyes and ears-on with the latest in tech, so companies are likely to focus on wowing you with a sensory experience designed to stand out from the rest of the pack.

INFILLION’S RECOMMENDATION: Try to schedule some time away from meetings to actually walk the CES show floor and get a hands-on experience with new innovations. IRL interaction’s never been more meaningful!

What’s the outlook on streaming devices?

For many households during the COVID era’s peak, the connected living room – powered by smart TVs and streaming video devices – became the center of their entertainment world. With movie theaters, Broadway, bars, and sporting events temporarily shuttered, finding a way to boost your home entertainment game became a major trend. But forecasters were surprised by slower sales of CTV devices in 2022. Global inflation, along with massive supply chain issues, created a perfect storm. Plus, a lot of people made their upgrades in 2020 or 2021 and will continue enjoying their new gadgets for the next few years. That being said: Things break, people move, and the streaming wars are only heating up, with more and more major players entering the game or merging (think Discovery and HBO). With inflation predicted to recede in the near future and supply chain issues gradually resolving, 2023 could be a rebound year for home entertainment.

One trend to look out for: media and device overload, and companies focusing on ease of use and functionality rather than infinite choice. Samsung, for one, has already announced that its CES theme is “Bringing Calm to a Connected World.”

INFILLION’S RECOMMENDATION: Subscription fatigue and frustrating user interfaces have been some of consumers’ biggest criticisms of the connected TV landscape. At CES, take a look at which publishers and hardware/software manufacturers are looking to address these directly.

Will this finally be VR’s big year?

Virtual reality hasn’t yet become the juggernaut that some predicted it would. In fact, it’s still in the process of taking its early wobbly steps. Facebook went so far as to rebrand its parent company to Meta and to sink billions of dollars into metaverse initiatives, including its new VR social network Horizon Worlds – which hasn’t exactly become the next Facebook. That being said, it would be a mistake to write VR off. Meta’s Quest 2 VR headset has proven that it’s possible to make VR that’s quite cheap, and really very good, without the need for a powerful gaming PC or a room full of elaborate sensors. (A new Quest is coming in 2023, and Sharp, which manufactures displays for the likes of Meta Quest, will be showing off a new prototype at CES.)

People now know that VR is real, and enough have tried it that it’s in the zeitgeist. While there still isn’t a steady enough flow of new marquee games to keep people hooked, 2023 is going to get very interesting when two 800-pound gorillas enter the room: Apple and Sony. Sony’s PSVR 2, which was announced at CES 2022, is hitting the market early in the year and is going to feature vastly upgraded hardware and a bunch of extremely tempting games. And, of course, nobody sets trends like Apple, whose presence is always felt at CES even though the company has not formally participated in 30 years. With its long-rumored mixed reality headset likely coming soon, too, expect a banner year for the virtual world, with a lot of previously reluctant consumers finally jumping onboard.

Keep an eye out for new developments in augmented reality (think Pokemon Go) and immersive gaming like Fortnite. It’s likely that these will gain footing sooner than anything that requires a headset does.

INFILLION’S RECOMMENDATION: Take all things metaverse with a grain of salt, but don’t discount them as too “far out” either. The brands that jump into the sandbox, so to speak, are the brands that will be platform-fluent when mainstream audiences arrive.

What will be the hottest topics in consumer privacy?

This is probably not news to you, but consumers have a complicated relationship with targeted ads. In Infillion’s research with Ipsos, 66% of consumers said they agree that “targeting is creepy,” but 50% agree that ads tailored to them and their interests are good. Meanwhile, the most prolific source of ad targeting – third-party cookies – is about to go into decline. Major companies like Google have announced plans to limit or even disable third-party data entirely, and a federal data privacy law may actually pass in 2023. Expect this trend to continue and expand, because the demand for it is real and it is loud.

Advertisers have had to think about new approaches, and among them is a greater reliance on first-party data. With CES offering up a hotbed of smart devices from cars to refrigerators, advertisers can turn a keen eye toward figuring out which of these may become tomorrow’s premium data sources.

INFILLION’S RECOMMENDATION: With both Big Tech and Congress on the verge of reshaping the ad targeting landscape, companies at CES will be working hard to pitch themselves as privacy-forward. It’s worth figuring out which ones are genuine about it.

Health and fitness tech boomed during COVID. What at CES can tell us what’s next?

Health and fitness tech has always been a major component of CES. Even as major phone, television, computer, and camera brands have started using the event more for hands-on experiences rather than major announcements, health and fitness companies have largely bucked that trend and use the event to lift the curtain on innovations that are often previously known about only through patent filings. Every year we see a slew of wearable health device debuts, along with innovative exercise gadgets, and industry analysts are speculating that we may see everything from a new Fitbit device to a smart toilet from Withings (you heard that right) previewed at CES 2023.

The pandemic has only turned up the spotlight on the importance of taking care of yourself, so expect to see a lot of health trackers (including some using innovative new sensors, such as blood markers), home gyms, and cool new outdoor equipment. For the most part, these smart devices aren’t destinations for ads (privacy concerns abound, and who really wants to see ads on their Fitbit anyway?), but it’s definitely a space to watch particularly when it comes to the conversation around first-party data.

INFILLION’S RECOMMENDATION: As a marketer, take a look at which fitness tech companies, many of which primarily retail direct-to-consumer, are looking to build market share. Especially with gyms long since reopened, companies that make smart personal fitness equipment may be looking to broaden their markets – and they could be looking for the advertising partners to help them do it.

Subscribe to our blog:

Related Posts:

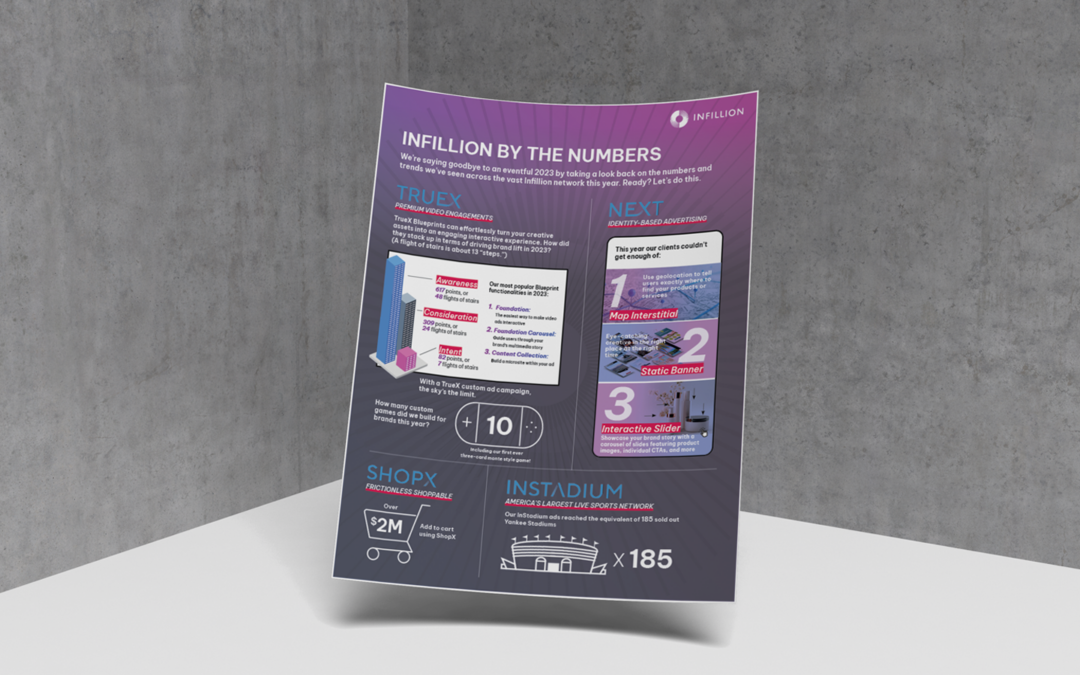

Infillion by the Numbers: See the Year’s Creative Stats

At Infillion, our tech and creative teams build for desktop, mobile, connected TV, and even sports stadiums. That’s a lot of platforms – and a lot of different creative strategies. What were some of our creative milestones in 2023? From brand lift to 3-card monte,...

2024’s Streaming TV Trends: What Our Industry Can Expect in the Year Ahead

Streaming TV business model changes, shoppable ads, generative AI, and a stronger push for collaboration will reshape next year’s advertising landscape. Here’s how. Ad spending roared back in the latter half of this year, indicating that there will be a healthy...

Ads Can Stress People Out, Especially Around the Holidays. Here’s How Brands Can Change That.

If you feel your nerves tighten a bit when you hear the sound of holiday bells jingling in a TV ad, you’re not alone. According to Healthline, 62% of Americans describe their stress levels as “very elevated” or “somewhat elevated” during the holiday season – and only...

Let's Connect!

Want to talk about CTV, the Metaverse or CES 2023?